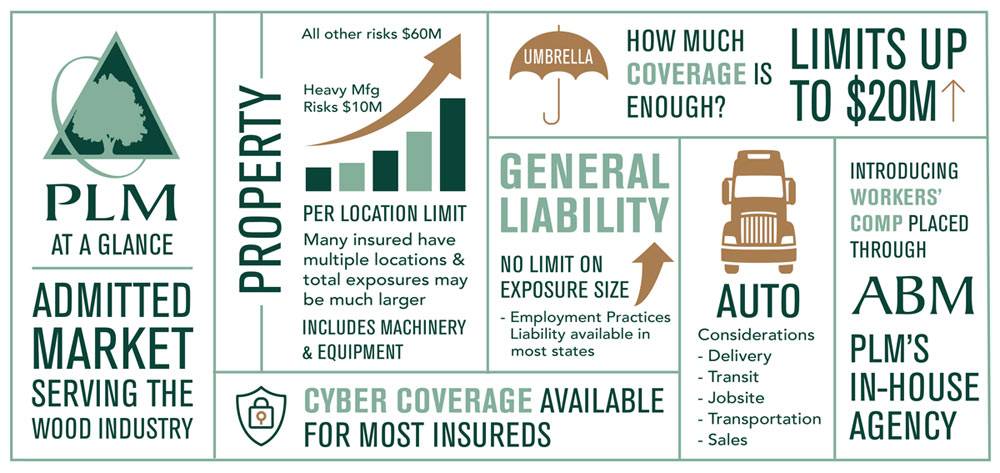

I get this question from both prospective insureds that want to do business with us, as well as from brokers who are attempting to identify a marketplace for their clients. While we have list of the typical types of business we pursue and write (see https://www.plmins.com/products-services/#who-we-protect), I think recent changes in the wood niche, with more carriers exiting, re-underwriting, or limiting their share and rising prices (particularly on larger auto exposures), our underwriting standards have created some confusion that I would like to clarify.

We act as craftsmen in developing policies for our clients. We understand that our insureds each have unique, severe risks. We aim to build the policy based on the coverages your business needs rather than throw all types of coverage packages at you (and charge accordingly), because that would indicate we don’t understand your business. Outside of our standard coverages and thresholds shown above, just about any other coverage you can think of can be added with appropriate underwriting information, adequate time for us to make an informed decision, proper pricing and a desire on our part to accept the risk.

RETAIL/WHOLESALE BMDs

Will you write Building Material dealers that are not Lumberyards?

Yes, we will write retail and wholesale building material dealers that focus on materials such as roofing, siding, electrical and products of this nature. We will also consider writing the dealers in hardscape and decorative stone.

Will you write “installed sales”?

Yes, but it is important to note that we are not interested in any full-blown contractor masquerading as a building material dealer. If the account is installing cabinets, decks, kitchens, bathrooms or things of the like, we usually have no problems. If you have a panel and/or truss operation, we want to fully understand that aspect of your business. If you are routinely building homes, we are going to look at that exposure closely.

Underwriting Considerations for installed sales include:

- A tight subcontracting contract in place that provides adequate limits

- A record keeping system that maintains all contracts

- Contracts in place with all subcontractors, naming the insured as an additional insured on the subs policy

- Evidence of stability in relationships between dealers and their subcontractors (or their own employees if they are doing the work in-house)

Will you write rental operations?

Yes, as part of the retail dealer or hardware store, as long as the insured can demonstrate that they have experience in this area. The operation should be renting small hand tools and things of this nature to their customers and must demonstrate tight control of the exposure. We are not interested when the insured is renting heavy contracting equipment or children’s party equipment (bounce houses, etc.) at this time.

What if the risk has a window and door shop?

Again, as part of a dealer, PLM should be considered a market, depending on the size of the operation. If they are making windows and doors for large multifamily projects, we are probably going to underwrite extensively and may decline. The size of this operation as compared to the overall operation will be considered. The state of domicile will also be considered; states with active construction defect environments will not be consider.

NOTE: This position is applicable to small independent window and door operations. We are very interested in high-end woodworking operations that do this, particularly if they do or supervise the installation themselves.

The risk has a truss operation and is booming trusses to the sill plate — are you interested?

Let’s split this question in half. Truss operations are not a problem in most states except for the 12 “Issue States” where we find the judicial environment is not favorable for defense. In those states, we will consider writing property-only coverage.

We write truss operations often as part of a dealer or as stand-alone operations. In some parts of the country, the norm is for the truss operation to “drop” the truss at the job site and depart. In others, it’s traditional for the manufacturer to boom the trusses to the sill plate. We are comfortable with both of these type operations. However, things get a bit hairy when the dealer or manufacturer starts booming up the trusses individually for installation. We really want them booming up the “bundle,” although, understandably, there may be some situations where there are individual trusses included in the overall delivery package.

We are not interested in the installation exposure, where there is a dramatic increase in risk that needs to be understood, analyzed and charged for. The true danger comes from the exposure of the trusses toppling while being installed and injuring workers. We also see instances where the workers walk along the bottom of the truss during installation, wherein the truss is not designed to handle this weight.

Further, the transportation of trusses causes an increase in hazard and, while we freely underwrite and insure this exposure, we do want to understand the controls in place for “wide loads.”

Issue States:

Alabama

California

Illinois

Louisiana

Maryland

Massachusetts

Nebraska

Nevada

New York

North Carolina

Rhode Island

Virginia

Do you write hardware stores?

Yes, although we find it difficult to compete in the marketplace when these are written on a Business Owners Policy (BOP) by our competitors. Until now, we have never aggressively pursued these risks. However, this area of our business is expanding. With the rollout of our rental guidelines as well as the development of workers’ comp placement through ABM, we expect significant growth in hardware stores in 2020 and beyond.

LIGHT MANUFACTURING

We insure a great many classes of operations in this area. Essentially if they are manufacturing with wood and creating sawdust, talk to us about it. Some examples of this are cabinet manufacturing, moulding and millwork, and woodworking shops.

SAWMILLS & HEAVY MANUFACTURING

Do you still want to write sawmills and other heavy manufacturing operations?

We will write primary wood manufacturing risks with limits of up to $10 million in value at any one location. In fact, we are very interested in smaller pallet, sawmill and other heavy wood manufacturing risks.

Keep in mind that the $10 million number is not per policy but per location, and the location must have no more than $10 million of values at it. In other words, we are not currently interested in writing a $10 million piece of a larger value at the location. We will consider all types of construction and both protected and unprotected risks. We expect to write the casualty on this when we write the property.

See the companion article discussing our position on the heavy manufacturing segment of the marketplace. Please contact us or your broker with further questions.