Over the years, the sawmill, pallet, and primary manufacturing industries have suffered significant losses. Sometimes even the best risk management does not mitigate a fortuitous loss.

As an insurance company, we have seen our insureds suffer devastating losses that have had long-lasting impacts on their businesses, employees, communities, and even their own families. These losses have simultaneously disrupted the insurance industry’s ability to produce a consistent profit in these classes. Over the past few years, PLM has made tough decisions in this segment in an attempt to improve its results and remain the best viable insurance carrier serving the entire wood and related building materials industries. Despite the continued efforts of PLM and our insureds, we have continued to experience multi-million dollar losses in primary manufacturing.

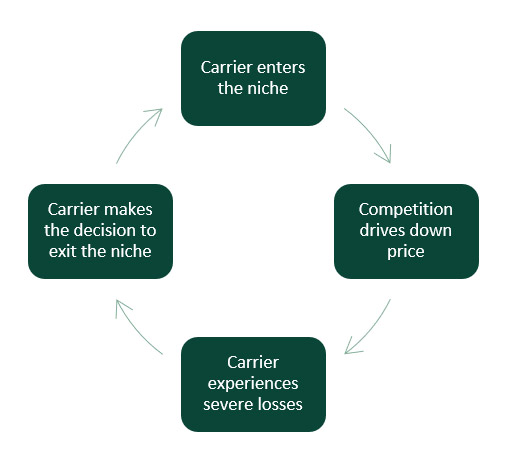

Though this segment represents 10% of PLM’s total written volume, the fact is, more often than not it has been, the main reason for disappointing financial results over the last decade. To curb these losses, we have put a lot of attention, effort, focus, and capital into potential solutions and continue to do so. If PLM, which has supported the industry continuously for 125 years, is still grappling with mounting losses in this market segment, you can imagine how other carriers that unknowingly jumped into the segment have fared.

Behind every insurer paying out claims is a reinsurer or multiple reinsurers offsetting those losses through the insurer’s own insurance coverage. After years of compounding losses, the reinsurance community’s willingness to extend coverage to this segment has dwindled dramatically as well. We are even seeing changes in the excess and surplus markets’ pricing and capacity in the primary manufacturing segment.

In late 2018, PLM made the decision to no longer participate in this segment of the marketplace where we could not adequately support losses through our pricing. We made the tough decision to reprice our primary manufacturing book where values exceeded $10 million at any single location. Early on, we saw a great deal of pushback from both brokers and insureds alike. However, in just the first two quarters of 2019, the market had virtually absorbed the business that left PLM.

Today is a different story.

Prices are rising across the entire segment and finding capacity is harder to do. Larger primary manufacturing accounts are having trouble finding full coverage, with many insureds and brokers having to deal with gaps in coverage in their program. “Layered programs” involving multiple carriers continue to exist in the marketplace, but even these are seeing an upward surge in pricing and limited capacity, leading to the inability to fill the entire limit needed by many insureds. The reinsurance marketplace that stands behind these carriers is no longer willing to support them. Why you ask? The reason is simple — a decade of unprofitability has finally caught up.

Over the past year, PLM has visited reinsurers across the globe to discuss this class of business and has confirmed that today there is little appetite for the business. Recent large losses in the primary manufacturing segment will continue to solidify those decisions.

PLM has long urged the primary wood manufacturing community and our broker partners to recognize this brewing concern. Now, a solution is needed. The question we get asked time and time again is, “Can PLM be that solution for this class of business?” The answer to that question is: maybe.

One of the fundamental covenants of the insurance business is that, in any single class of business, we must generate enough premium from that class to pay for all of its losses, cover all of its expenses, and maintain a fair profit that is worthy of the insurance company risking its capital. I suspect this is not so much unlike the covenants of your own business.

Neither primary manufacturing nor the wood industry as a whole is a frequency business. Good, fair, and even poorly-rated insureds can go for many years without a loss, right until the day the entire plant burns, falls, or is blown down. In the severity class of business, insurance for the entire class must be priced high enough so that when loss occurs, you have adequate premium to pay the loss, cover all of your expenses, and still generate a fair profit.

Looking Ahead

Individual risk management programs, a safety focus, training, and physical attributes of a risk will remain key in the decision to work with an insured. Previous loss history will continue to be scrutinized. However, at the end of the day, the solution to our loss and capacity problems is going to be rate-per- exposure unit (premium) in conjunction with all of those other things. The larger the values at any one location, the more rate that will be needed. Our experience, as well as that of the industry as a whole, shows that the higher the values, the larger the loss potential when the fire does start!

Insurance carriers will consider their ability to serve the segment as a whole only as soon as individual risks are priced correctly. Until that happens, and in our estimation, insureds with values of more than $10-12 million at any one location will face a difficult time finding coverage with a single insurance carrier or a group of carriers that will not only remain committed and focused on the segment but will work with insureds to provide appropriate loss control and claims services for this unique class of business.

There have been talks in different circles about forming “captives” to fulfill this need. The thought is enticing, but the reality is that whether the insurance is written by a captive, a mutual, or stock insurance company, it does not change the need for adequate pricing for the exposure presented. Though a captive can be appealing in the short term, the structure simply will not work long term, unless the captive chooses an adequate rate.

So, while it is unpopular, the solution to bringing capacity back into the marketplace and relieving stress on the ability to find coverage is a simple one. Representatives from the insurance industry need to gather a group of high-quality, safety-focused, insureds together and work with them to provide tailored solutions and loss control services to guide them. Then, the insurers must impose realistic rates and premiums to adequately cover any future losses.

At PLM, the energy that we have put into this segment over the years is a testament to our commitment to serving the wood and related building materials industries. Our loss control programs, surveying schedules, and specialized underwriting team were all designed with understanding your unique risks and to offer risk management solutions to help mitigate your losses. We strive to create mutually beneficial relationships with all of our policyholders. While others fled the segment, PLM finished 2019 with over 700 locations insured by PLM and, for us, this business is profitable.

Whether we enter the large-value marketplace will be determined by the laws of supply and demand and the willingness of brokers and insureds to recognize our value and partner with us. There also needs to be a willingness to accept the rates that we think are necessary to attract, and just as importantly, retain reinsurers that will stand behind us in our support of the large primary manufacturing segment. An insured’s commitment to safety and ownership attitudes toward risk management will also continue to be critical to the relationship. At the same time, PLM will continue to commit efforts to improving and enhancing the safety of our insureds.

We understand that this solution is not easy when you have your own margins to manage. However, we hope you recognize the value of partnering with an insurance carrier that understands your unique needs and remains committed to serving you. We will be your insurance partner, not only in times of crisis, but in times of change and in growth for your business.

This is a difficult time, and it could get worse before it gets better and market capacity comes back into the marketplace. In my 40 years in the insurance business, I have never seen a market like the one that primary manufacturers are confronting. Let PLM be the trusted partners to guide your business through this challenging time.

Finally remember this, “It’s always the other guy whose plant burns down, until it isn’t.”